Printable 1099 Form Independent Contractor

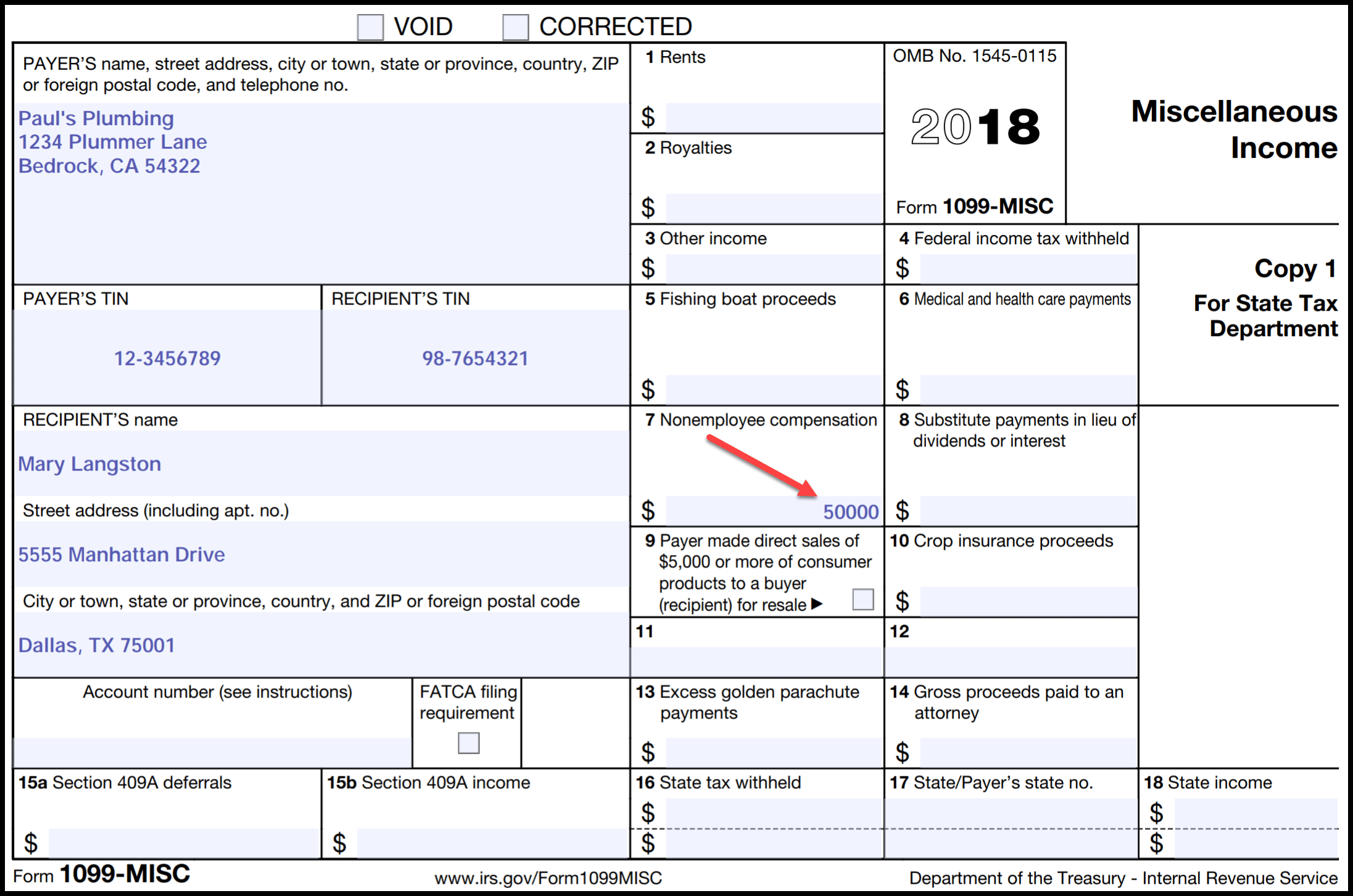

Printable 1099 Form Independent Contractor - The letters must clearly define the contractor’s role, scope of work, and. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. Understanding the intricacies of 1099 forms, their purpose, different types, and the correct procedures for filing is essential for both independent contractors and the businesses hiring them. This form is used to report certain income payments to recipients and the irs. How to fill out form 1099 for independent contractor? Understanding what a 1099 form is, how it affects your taxes, and what to do when. One of the key tax forms independent contractors should be familiar with is the 1099 form. To fill out the 1099 form, start by gathering all necessary information from your independent contractors. It includes information on how to file, what types of income to report, and how to correct errors. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. What is a 1099 contractor? Understanding the intricacies of 1099 forms, their purpose, different types, and the correct procedures for filing is essential for both independent contractors and the businesses hiring them. A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. Once 1099 forms are prepared according to irs standards, businesses must distribute them to recipients, such as independent contractors or service providers, who use. You must also complete form 8919 and attach it to your return. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. This form is used to report certain income payments to recipients and the irs. To fill out the 1099 form, start by gathering all necessary information from your independent contractors. This form is essential for. One of the key tax forms independent contractors should be familiar with is the 1099 form. This form is essential for. You must also complete form 8919 and attach it to your return. A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. If. You must also complete form 8919 and attach it to your return. Exploring the different types of form 1099. If your organization paid over $600 for services this year or withheld. One of the key tax forms independent contractors should be familiar with is the 1099 form. Once 1099 forms are prepared according to irs standards, businesses must distribute them. Ensure that you have their taxpayer identification number (tin) and business. A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. Here are the most common. Understanding what a 1099 form is, how it affects your taxes, and what to do when. Independent contractors. Here are the most common. This form is used to report certain income payments to recipients and the irs. Report payments of $600 or more made in the course of a business in rents, prizes and awards, other income and for other specified purposes, including gross proceeds paid to. What is a 1099 contractor? Independent contractors manage their own tax. As the 2025 tax season approaches, independent contractors must ensure that they file their taxes correctly, particularly by submitting form 1099. You must also complete form 8919 and attach it to your return. Once 1099 forms are prepared according to irs standards, businesses must distribute them to recipients, such as independent contractors or service providers, who use. A 1099 form. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. It includes information on how to file, what types of income to report, and how to correct errors. Understanding what a 1099 form is, how it affects your taxes, and what to do when. Learn what an independent. One of the key tax forms independent contractors should be familiar with is the 1099 form. If your organization paid over $600 for services this year or withheld. There are nearly two dozen different kinds of 1099 forms, and each. How to fill out form 1099 for independent contractor? What is a 1099 contractor? Independent contractors manage their own tax withholdings and provide evidence of work and income. As the 2025 tax season approaches, independent contractors must ensure that they file their taxes correctly, particularly by submitting form 1099. Once 1099 forms are prepared according to irs standards, businesses must distribute them to recipients, such as independent contractors or service providers, who use. A. How to file form 1099 with taxbandits? How to fill out form 1099 for independent contractor? Understanding the intricacies of 1099 forms, their purpose, different types, and the correct procedures for filing is essential for both independent contractors and the businesses hiring them. Learn what an independent contractor 1099 form is, why you need it, and how to file it.. If your organization paid over $600 for services this year or withheld. Ensure that you have their taxpayer identification number (tin) and business. Understanding what a 1099 form is, how it affects your taxes, and what to do when. Once 1099 forms are prepared according to irs standards, businesses must distribute them to recipients, such as independent contractors or service. How to fill out form 1099 for independent contractor? The irs provides several variations of form 1099, each designed to report a specific type of income. Ensure that you have their taxpayer identification number (tin) and business. There are nearly two dozen different kinds of 1099 forms, and each. Understanding what a 1099 form is, how it affects your taxes, and what to do when. As the 2025 tax season approaches, independent contractors must ensure that they file their taxes correctly, particularly by submitting form 1099. It includes information on how to file, what types of income to report, and how to correct errors. Independent contractors are among the recipients who should receive a 1099 form. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. Understanding the intricacies of 1099 forms, their purpose, different types, and the correct procedures for filing is essential for both independent contractors and the businesses hiring them. What is a 1099 contractor? One of the key tax forms independent contractors should be familiar with is the 1099 form. This form is essential for. You must also complete form 8919 and attach it to your return. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. If your organization paid over $600 for services this year or withheld.Printable Independent Contractor 1099 Form Printable Forms Free Online

Printable 1099 Form Independent Contractor Printable Form, Templates

Printable 1099 Form Independent Contractor 2023

Free Independent Contractor Agreement Template 1099 Word PDF eForms

Printable 1099 Forms For Independent Contractors Form Resume

Printable Form 1099 Misc

Printable 1099 Forms For Independent Contractors

IRS Form 1099 Reporting for Small Business Owners

Printable 1099 Forms For Independent Contractors

Printable 1099 Forms For Independent Contractors

Once 1099 Forms Are Prepared According To Irs Standards, Businesses Must Distribute Them To Recipients, Such As Independent Contractors Or Service Providers, Who Use.

A 1099 Contractor, Often Referred To As An Independent Contractor,.

The Letters Must Clearly Define The Contractor’s Role, Scope Of Work, And.

This Form Is Used To Report Certain Income Payments To Recipients And The Irs.

Related Post: